Maryland, January 9, 2026

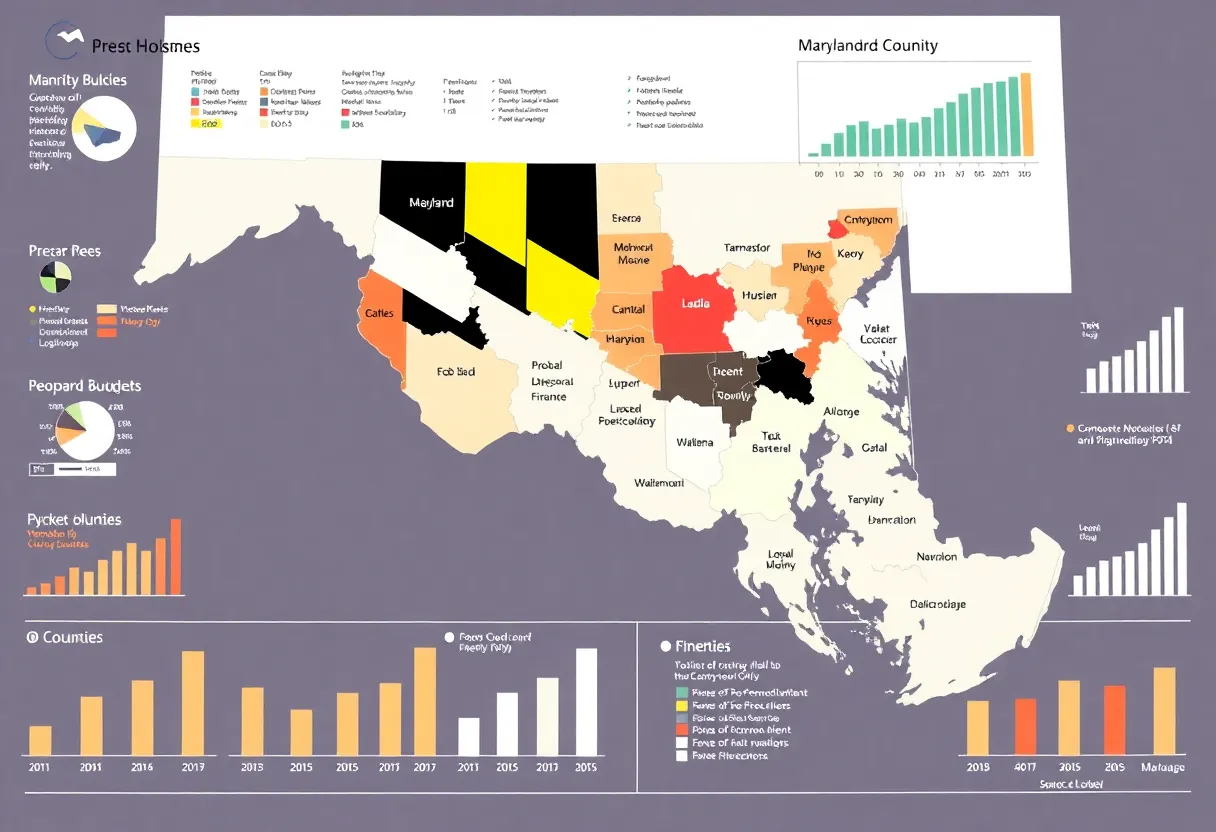

The Maryland Association of Counties has unveiled the ‘Financial Snapshot Fiscal Year 2026,’ detailing county budgets, tax rates, and revenue trends statewide. This report shows a 3.3% increase in general fund revenues since 2024, bolstered by rising property and income tax collections. The comprehensive analysis provides insights into the financial health of individual counties, such as Montgomery County, and is available for public access on the MACo website.

Maryland Releases Fiscal Year 2026 Financial Snapshot

ANNAPOLIS, MD – The Maryland Association of Counties (MACo) has published the “Financial Snapshot Fiscal Year 2026: Budgets, Tax Rates, and Selected Statistics,” providing a comprehensive overview of county budgets, tax structures, and revenue trends across the state. This annual report is now accessible on the MACo website.

Key Highlights

- Statewide Budget Overview: The Fiscal Year 2026 budget for Maryland counties reflects a 3.3% average annual increase in general fund revenues since Fiscal Year 2024, totaling $21.8 billion.

- Property Tax Collections: Property tax collections have seen a significant rise, contributing to the overall increase in local tax revenues.

- Income Tax Revenues: Income tax revenues have also experienced growth, bolstering county budgets.

- Recordation and Transfer Taxes: These taxes have shown positive trends, adding to the financial health of counties.

- Service Fees and Charges: Increases in service fees and charges have provided additional revenue streams for counties.

County-Specific Insights

The report offers detailed data on individual counties, including tax rates, revenue sources, and budget allocations. For instance, Montgomery County’s operating budget for Fiscal Year 2026 is $54,948,439, encompassing physical and electronic collections, staff, and programs.

Accessing the Report

The full “Financial Snapshot Fiscal Year 2026: Budgets, Tax Rates, and Selected Statistics” report is available on the MACo website. This resource is invaluable for understanding the fiscal landscape of Maryland’s counties and the financial strategies employed to meet local needs.

Background

The Maryland Association of Counties (MACo) is a non-profit organization that represents the 23 counties and Baltimore City in Maryland. MACo advocates for effective and efficient county government and provides a forum for county officials to discuss and address issues of common concern.

Frequently Asked Questions (FAQ)

What is the “Financial Snapshot Fiscal Year 2026: Budgets, Tax Rates, and Selected Statistics” report?

This annual publication by the Maryland Association of Counties provides a comprehensive overview of county budgets, tax structures, and revenue trends across Maryland for Fiscal Year 2026.

Where can I access the full report?

The full report is available on the Maryland Association of Counties (MACo) website.

What are the key highlights of the Fiscal Year 2026 budget?

The report highlights a 3.3% average annual increase in general fund revenues since Fiscal Year 2024, totaling $21.8 billion, with significant rises in property tax collections, income tax revenues, recordation and transfer taxes, and service fees and charges.

Can I find county-specific financial data in the report?

Yes, the report offers detailed data on individual counties, including tax rates, revenue sources, and budget allocations.

Who is the Maryland Association of Counties (MACo)?

MACo is a non-profit organization that represents the 23 counties and Baltimore City in Maryland, advocating for effective and efficient county government and providing a forum for county officials to discuss and address issues of common concern.

Key Features of the Fiscal Year 2026 Financial Snapshot

| Feature | Description |

|---|---|

| Statewide Budget Overview | Provides a comprehensive overview of county budgets, tax structures, and revenue trends across Maryland for Fiscal Year 2026. |

| Property Tax Collections | Highlights significant rises in property tax collections contributing to the overall increase in local tax revenues. |

| Income Tax Revenues | Details growth in income tax revenues bolstering county budgets. |

| Recordation and Transfer Taxes | Shows positive trends in recordation and transfer taxes adding to the financial health of counties. |

| Service Fees and Charges | Highlights increases in service fees and charges providing additional revenue streams for counties. |

| County-Specific Insights | Offers detailed data on individual counties, including tax rates, revenue sources, and budget allocations. |

| Accessing the Report | Provides information on accessing the full report available on the MACo website. |

| Background | Provides background information on the Maryland Association of Counties (MACo), a non-profit organization representing the 23 counties and Baltimore City in Maryland. |

Deeper Dive: News & Info About This Topic

HERE Resources

Evanston School District Responds to Leaked Closure Proposal

How to Effectively Evaluate Real Estate Market Reports Before Buying Your First Home

Author: STAFF HERE BALTIMORE WRITER

The BALTIMORE STAFF WRITER represents the experienced team at HEREBaltimore.com, your go-to source for actionable local news and information in Baltimore, Baltimore County, and beyond. Specializing in "news you can use," we cover essential topics like product reviews for personal and business needs, local business directories, politics, real estate trends, neighborhood insights, and state news affecting the area—with deep expertise drawn from years of dedicated reporting and strong community input, including local press releases and business updates. We deliver top reporting on high-value events such as the Baltimore Book Festival, Preakness Stakes, and Artscape. Our coverage extends to key organizations like the Baltimore Chamber of Commerce and Visit Baltimore, plus leading businesses in shipping and healthcare that power the local economy such as the Port of Baltimore and Johns Hopkins Medicine. As part of the broader HERE network, we provide comprehensive, credible insights into Maryland's dynamic landscape.